Rain.Credit

a transparent view to lenders or other borrowers that grows and creates a more secure ecosystem.

Crypto lending is a growing market that started only a few years ago. Unless you’re new to cryptocurrency, you’ve probably heard this term at some point. Crypto lending works similarly to peer-to-peer lending, where the borrower connects with the lender via an online crypto lending platform with cryptocurrency as the trading currency, not fiat money. Technically, the more correct term is a loan secured by crypto since not all loans are denominated in cryptocurrency.

Individual investors or traders often use their crypto assets as collateral for cash loans that can be used for investment or as working capital. The mechanism may differ depending on the crypto lending platform, but simply put, borrowers use their crypto assets such as bitcoin, as collateral to get a fiat loan or stablecoin loan. The lender then provides the asset for this loan in exchange for the interest rate on the asset.

Now I want to invite you to explore the Best DeFi Lending Platforms.

Yups, It’s Rain.Credit.

Let’s find out…

What is Rain.Credit?

Rain.Credit is a BEP20 token on the Binance Smart Chain that acts as an Oracle Aggregator non-custodial Off-Chain Data analyzer that assigns a short Credit rating to a user’s address. This credit rating is used to provide a better collateral factor for lenders and borrowers of digital assets on the rain platform. Rain.Credit is based on the current decentralized lending platform and protocol, but with various changes to bring more innovative designs and experiences.

What makes Rain.Credit so unique?

What makes us so unique is how we will use Off-Chain Aggregate analysis to help reduce investor exposure as they begin to interact with our ecosystem.

The benefits of our ecosystem from this innovation are quite simple. A user who provides as much information as possible about his transaction history across multiple chains will need less assurance than a user with an unclear transaction history. This provides a transparent view to other lenders or borrowers which in turn creates a safer ecosystem. Users providing this information will also have additional access to $ RAIN tokens available to borrowers without requiring additional collateral. The number of tokens a borrower can receive is based on the user’s Aggregate transaction history of the rank value derived from Oracle’s Rain Off-Chain Analytics. The formula for determining the amount of $ RAIN tokens to be lent is as follows:

RAIN = Amount to borrow + Transaction History / Amount to secure

Off-Chain API interface for third party integration with other companies, protocols, developers and deFi applications will be provided. Some of the key features that will be available include multiple POST and GET endpoints for multiple Layer 1 and Layer 2 Ethereum chains. Over time, other features will be introduced, some of these features are: Integration with external data providers and directories, Decentralized account blacklist tracker, smart contract analysis, on-chain and off-chain equity and asset measurement, loan aggregation engine, Joint AMM across the chain, Investment Intelligence, and many more will be released in the future free to members of the $ RAIN community.

Oracles provide solutions to transparency problems that face many defi projects. By releasing chain information and supplying data in an unchanging manner, Rain.Credit Oracle enables smart contracts to pull data from blocks containing the information needed. The information that Rain.Credit oracle sends will include things that the blockchain cannot track or monitor. This includes payment history of users across multiple chains, real world economic events, government policy changes, and user account history.

By providing a completely transparent layer, trust is embedded in both lenders and borrowers. Instead of blindly lending crypto assets to someone without a history of proof of previous loan eligibility, the lender can view the user’s previous payment history with other lending protocols and determine the required collateral amount dynamically (more for risky lenders). This allows the lending protocol to have more precise control over asset allocation for specific users depending on their credit score. Other external factors could also influence this belief, but they would not have been possible without the information Rain provided Oracle Credit.

By taking advantage of the Collateral Payable Position used by Compound, Aave, Cream and other providers while also aggregating the assets collected through our AMM. The user will have a completely different experience that is not seen with other loan providers. With $ RAIN, you can borrow up to 70% of your collateral (for example you can borrow 70 BNB and the equivalent in BUSD, DAI or any other stable coin with 100 BNB posted as collateral).

Users who take an additional $ RAIN loan token will be charged additional interest and must meet the payment on time. If the user is unable to meet the repayment agreement before the liquidation occurs, the user will be subject to a less positive analytics rating which will reduce their chances of getting another loan on the platform.

Tokenomics

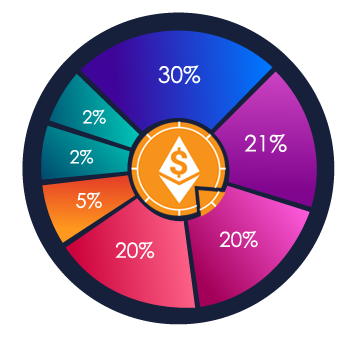

$ RAIN has a simple distribution model. The total supply consists of 800,000 $ RAIN. The distribution of tokens is as follows:

40% will be sold via presale.

20% will be used for project development.

20% will be used to provide liquidity and agricultural products.

10% tokens will be allocated to the team (For 2 years, these tokens will be locked to instill trust in the community).

10% will be used for marketing.

Rain.Credit Roadmap

K2–2021 (Musim Testnet)

Our focus for the second quarter of 2021 is to equip the platform with Oracle and the Lending platform to work effectively on the testnet in record time. We also aim to further build on the Oracle platform by building a “Trust Network”, which motivates data providers.

- $ RAIN token Presale (read more)

- Exchange List

- Testnet Off-Chain Aggregation Oracle Analytics

- Testnet Loan Platform.

- Testnet Trust Network

- Launch of Betting and Deflation Farming

K3–2021 (Musim Mainnet)

Our focus for the start of the third quarter of 2021 is to equip the platform with Oracle and the Lending platform migrating from Testnet to Mainnet in record time. We also aim to further build on the Oracle platform by launching a “Trust Network”, which incentivizes data providers.

- Contract Audit Loan and Oracle

- Mainnet Off-Chain Oracle Analytics

- Mainnet Loan Platform

- Aggregated Data Provider

- Trust Network

- RAIN Oracle Hackathon

K4–2021 (Middleware season)

This quarter will be heavily focused on mid-sized device integration and a period that will appeal to our community with the launch of the RAIN Drop RAIN Governance.

- Oracle Network Release 2.0 (Beyond Aggregation Analysis)

- Off-Chain Oracle Marketplace release supporting multiple chains

- RAIN GraphQL Abstraction Layer Launched

- RAIN DAO Governance

- Release of Off-Chain Asset Management and Monitoring Platform

- Release of Off-Chain Asset Management and Monitoring Platform (One-Click Integration with non-blockchain based platforms)

- Comprehensive API Release and Documentation

K1–2022 (Cross Season)

The First Quarter will see a focus on Cross-Chain integration outside the Ethereum network with the aim of making our services available on various blockchain networks.

- Cross Chain Collateral Loans

- Launch of the Cross-Chain Oracle

- Smart Contract Analysis Platform

- Cross-Chain Trust Score (Outside the Ethereum Network)

- Asset Group Trust Score

- Continuous development and improvement of the Trust Network

- Academic research and publication of the impact of Trust Score in the DeFi sector

Tim Kredit Rain

Rainbuilder / Developer Lead

Greetings /

Drizzle Developer /

Monsoon Community Manager / UI / UX Designer

Conclusion

Rain.Credit takes the opportunity to create a more trustworthy ecosystem while also providing incentives to participate in borrowing and lending to increase users’ Credit scores. The use of off-chain analysis to build trust in lending and borrowing in the deficit space is something that has not been explored before the loan has been processed. With the ability to use real-life information and events as a factor in decision making, users need not worry too much about credibility, trustworthiness, higher assurance factors, and focus on using their assets to help grow their portfolios while participating in innovative and innovative platforms. + s

I For more information on RAIN.CREDIT, click the link below

OFFICIAL LINK WEB SITE: https://rain.credit/

TWITTER: https://twitter.com/rain_credit

TELEGRAM GROUP: https://t.me/joinchat/UqEl0GyJZ4WkDUWR

GITHUB: https://github.com/orgs/Rain-Credit

MEDIUM: https://rain-credit.medium.com/

DISCORD: https://discord.gg/aEc7NWbU

by AlphonsoDavies

link url ;https://bitcointalk.org/index.php?action=profile;u=3122525

PROBLEM CURRENTThe average person in the world currently saves 1.5 kilograms a day.Waste, this waste is generated with a variability of 0.70 kg to 2 kg per day depending on the country, but it is not only useless for this waste if it is not only a recycling plant but no company like us about its value We throw away and throw away important information without losing .

PROBLEM CURRENTThe average person in the world currently saves 1.5 kilograms a day.Waste, this waste is generated with a variability of 0.70 kg to 2 kg per day depending on the country, but it is not only useless for this waste if it is not only a recycling plant but no company like us about its value We throw away and throw away important information without losing . DECISIONWasteinfonet develops a truly innovative and revolutionary method that converts the waste that every resident of the world generates on a daily basis into useful information for making important decisions that will significantly increase the value of the company’s production by creating new and accurate channels. Information that goes far beyond all types of surveys, forecasts and forecasts.

DECISIONWasteinfonet develops a truly innovative and revolutionary method that converts the waste that every resident of the world generates on a daily basis into useful information for making important decisions that will significantly increase the value of the company’s production by creating new and accurate channels. Information that goes far beyond all types of surveys, forecasts and forecasts. BONUS PROGRAMOur database of consumers who are actively involved in working with us in the information chain and management also receive rewards for cryptocurrency tokens (WIF) and / or, if they fail, direct payments according to their geographic area, loyalty rewards, this is a bonus. This requires a very simple task. Only every consumer in the household has to scan the barcode of used products, which are discarded on a daily basis. In return, they receive a monthly bonus which is credited to each wallet.Active Member Support ProgramOn the other hand, we want you to tell your friends, acquaintances, neighbors and colleagues about our working model and come together to integrate a growing database. The loyalty program will be part of the incentive to increase the number of consumers who are also actively working. …

BONUS PROGRAMOur database of consumers who are actively involved in working with us in the information chain and management also receive rewards for cryptocurrency tokens (WIF) and / or, if they fail, direct payments according to their geographic area, loyalty rewards, this is a bonus. This requires a very simple task. Only every consumer in the household has to scan the barcode of used products, which are discarded on a daily basis. In return, they receive a monthly bonus which is credited to each wallet.Active Member Support ProgramOn the other hand, we want you to tell your friends, acquaintances, neighbors and colleagues about our working model and come together to integrate a growing database. The loyalty program will be part of the incentive to increase the number of consumers who are also actively working. …

METHODS DEVELOPED FOR INFORMATION PRODUCTION.In an old project, a manual system was used to collect various classifications of waste at home. The forms were then submitted using a special model developed by the informants, which involved very complex, difficult, inaccurate and untimely work. With the new technologies we’ve combined, we add precision, speed, precision, security and multiple utility to the classification and processing platform.

METHODS DEVELOPED FOR INFORMATION PRODUCTION.In an old project, a manual system was used to collect various classifications of waste at home. The forms were then submitted using a special model developed by the informants, which involved very complex, difficult, inaccurate and untimely work. With the new technologies we’ve combined, we add precision, speed, precision, security and multiple utility to the classification and processing platform. PRODUCT DEVELOPMENT.Creation of an application for Android and iOS devices to scan products and their barcode.Traceability of data transmission and reception networks to the platform.Information processing program.Network protocol.Alternative payment methods are provided for several locations.The platform communication system is developed with the customer company.Artificial intelligence begins.Database creation that provides a platform and team with contact information for companies in the starting country as well as a database with information generators.A committee is formed and meets to evaluate and make continuous improvements.

PRODUCT DEVELOPMENT.Creation of an application for Android and iOS devices to scan products and their barcode.Traceability of data transmission and reception networks to the platform.Information processing program.Network protocol.Alternative payment methods are provided for several locations.The platform communication system is developed with the customer company.Artificial intelligence begins.Database creation that provides a platform and team with contact information for companies in the starting country as well as a database with information generators.A committee is formed and meets to evaluate and make continuous improvements. Even though our project is not oriented towards waste recycling and the big problem that implies it worldwide, with all the costs it incurs for every country and the future problems implied by the fact that waste has projections to occupy a large part of the planet, in addition to all the pollution problems in rivers, seas and cities. We have decided to make a contribution through “Donation”. give all of our information to non-profit environmental-conscious entities, because we consider it our duty and social responsibility to help fight pollution.We will transfer to public welfare agencies, government entities and environmental organizations, information that will help us live in a better world. This information will basically be reprocessed into plastic, cardboard, glass and complex materials waste. This reprocessing will be carried out completely “free of charge” and it will allow them to know the waste and type of waste in each area, as well as its quantity and characteristics. We believe that monetizing our business model is our big challenge, but on the other hand, preserving the environment by providing valuable information to those who are struggling and working to live in a better and less polluted world is also part of us.

Even though our project is not oriented towards waste recycling and the big problem that implies it worldwide, with all the costs it incurs for every country and the future problems implied by the fact that waste has projections to occupy a large part of the planet, in addition to all the pollution problems in rivers, seas and cities. We have decided to make a contribution through “Donation”. give all of our information to non-profit environmental-conscious entities, because we consider it our duty and social responsibility to help fight pollution.We will transfer to public welfare agencies, government entities and environmental organizations, information that will help us live in a better world. This information will basically be reprocessed into plastic, cardboard, glass and complex materials waste. This reprocessing will be carried out completely “free of charge” and it will allow them to know the waste and type of waste in each area, as well as its quantity and characteristics. We believe that monetizing our business model is our big challenge, but on the other hand, preserving the environment by providing valuable information to those who are struggling and working to live in a better and less polluted world is also part of us. BONUS PROGRAMOur database of consumers who actively participate in working with us in the information chain and management, will also receive prizes in cryptocurrency tokens (WIF) and / or if they fail, direct payments according to their geographic area, loyalty bonuses, these bonuses will require a task that is very simple, only every consumer in the house has to scan the barcode of the consumed products that are discarded every day, for this they will receive a monthly Bonus which will be credited to each wallet.REFERENCE PROGRAM FOR ACTIVE MEMBERSOn the other hand, we want you to tell your friends, acquaintances, neighbors, colleagues about our working model, and join together to integrate a growing database, the Bonus program will be part of an incentive measure to increase consumers who are also actively working. with us in a special program requested, and for each active referral you will receive an extra reward, we will use several scales so that according to the number of members you contribute, it is your Bonus payment, and it must be taken into account that It will be paid according to the day -the day you cooperate by providing information.

BONUS PROGRAMOur database of consumers who actively participate in working with us in the information chain and management, will also receive prizes in cryptocurrency tokens (WIF) and / or if they fail, direct payments according to their geographic area, loyalty bonuses, these bonuses will require a task that is very simple, only every consumer in the house has to scan the barcode of the consumed products that are discarded every day, for this they will receive a monthly Bonus which will be credited to each wallet.REFERENCE PROGRAM FOR ACTIVE MEMBERSOn the other hand, we want you to tell your friends, acquaintances, neighbors, colleagues about our working model, and join together to integrate a growing database, the Bonus program will be part of an incentive measure to increase consumers who are also actively working. with us in a special program requested, and for each active referral you will receive an extra reward, we will use several scales so that according to the number of members you contribute, it is your Bonus payment, and it must be taken into account that It will be paid according to the day -the day you cooperate by providing information.